copyright exchanges are rapidly revolutionizing the landscape of international transactions, offering a innovative approach to facilitating cross-border payments. By leveraging the distributed nature of blockchain technology, copyright exchanges provide a transparent platform for sending and receiving funds across borders with minimal fees and swift processing times. This overcomes the traditional obstacles associated with conventional financial systems, empowering individuals and businesses to transact funds globally in a more streamlined manner.

Your copyright Portal: Bitcoin & BTC Access

Stepping into the realm of digital assets can seem daunting, but a platform for copyright trading acts as your bridge. This online marketplace enables you to purchase Bitcoin and other cryptocurrencies with relative ease. You might be a seasoned investor or just starting your copyright exploration, a secure exchange is essential.

Choosing the right marketplace depends on your preferences. Consider factors like fees, security measures, and range of coins. Thoroughly research different exchanges to find the perfect fit for your investment strategy.

Digital Currency and Global Connections: How Bitcoin Empowers International Trade

In an increasingly globalized world, the traditional financial system often struggles to support seamless transactions across borders. Enter copyright, a revolutionary technology that promises a new paradigm for global payments. Bitcoin, the pioneering digital asset, has emerged as a popular choice for individuals and businesses seeking to execute transactions autonomously of centralized institutions.

Bitcoin's decentralized nature allows for direct transactions without the need for intermediaries like banks. This expedites the process, reducing fees and optimizing transaction speeds. Moreover, Bitcoin is highly secure, mitigating the risk of fraud and tampering. As a result, it has gained traction as a viable alternative for international business, particularly in regions where traditional financial systems are fragile.

- Furthermore, Bitcoin's value is not tied to any fiat currency, making it a protection against inflation and economic volatility. This characteristic can be particularly attractive to individuals in countries facing currency devaluation.

- Therefore, Bitcoin has the potential to empower individuals and businesses by providing them with greater control. It can cultivate economic growth in developing nations by bridging access to financial services.

{However|Despite this|, challenges remain. Bitcoin's price fluctuates widely, which can discourage some users. Regulatory inconsistency also poses a hurdle to its wider adoption. Nonetheless, the potential of Bitcoin to revolutionize global payments is undeniable. As technology continues to evolve and regulatory frameworks become clearer, Bitcoin is poised to play an increasingly significant role in shaping the future of finance.

Decentralized Finance: Revolutionizing Cross-Border Payments

Decentralized finance platforms, or DeFi, is shaking the landscape of cross-border payments. Traditional systems are often costly, relying on third parties. DeFi offers a distributed alternative, allowing for faster and cheaper transactions between borders.

This innovation utilizes smart contracts to facilitate secure and transparent payments. Users can access DeFi platforms to exchange currencies immediately, bypassing the necessity for traditional financial institutions.

- Additionally, DeFi promotes financialaccess by empowering individuals in underserved markets to participate in the global economy.

- Therefore, DeFi has the potential to disrupt the cross-border payments industry, creating a greater inclusive financial system for all.

The Future of Remittances: copyright Exchanges and Bitcoin's Impact

As worldwide economy becomes increasingly interconnected, remittances - money shipped between borders - are playing an greater vital role. , Historically,. remittances functioned on banks, which often result in high fees and inefficient processing times. However, the emergence of copyright exchanges and Bitcoin is transforming this landscape.

- copyright's decentralized nature allows for faster and less costly transactions, making it an appealing alternative to traditional remittance methods.

- , Moreover,, copyright exchanges are increasingly providing specialized services for remittances, simplifying the process and providing users with improved transparency and authority.

- This evolution is highly favorable for migrant workers who often depend on remittances to support their families back home.

While there are still hurdles to overcome, such as regulatory uncertainty and volatility in the copyright market, the potential of copyright exchanges and Bitcoin to revolutionize the future of remittances is undeniable.

Navigating Finance Globally: The Role of copyright Exchanges

copyright exchanges are revolutionizing global finance by providing a efficient platform for cross-border payments. With blockchain technology at their core, these exchanges enable fast, low-cost transactions between national borders, minimizing traditional financial intermediaries and their associated fees. This disruption empowers individuals and businesses to leverage global markets with unprecedented ease and speed.

copyright exchanges are particularly advantageous for remittances, where sending money internationally can be both costly and time-consuming. By leveraging crypto exchange copyright's decentralized nature, these platforms offer a faster alternative, allowing families to send funds to loved ones with greater affordability.

- Moreover, copyright exchanges are facilitating international trade by streamlining the process of processing payments. This reduces transaction costs and delays, making it more convenient for businesses to engage global commerce.

- Therefore, the rise of copyright exchanges is creating new opportunities for economic growth and interconnectivity on a global scale.

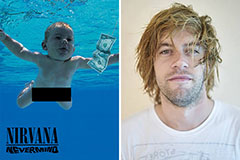

Spencer Elden Then & Now!

Spencer Elden Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now!